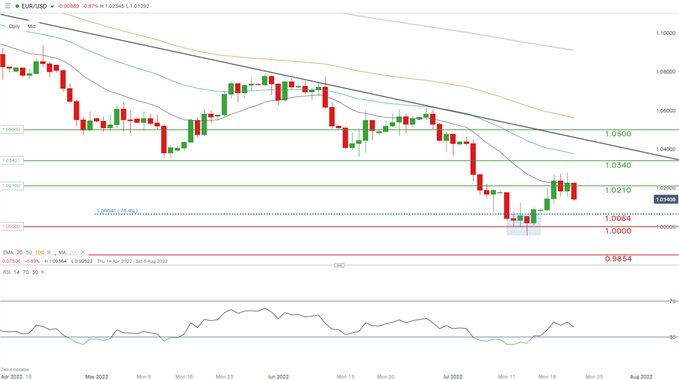

EUR/USD ANALYSIS AND COMMUNICATION POINTS

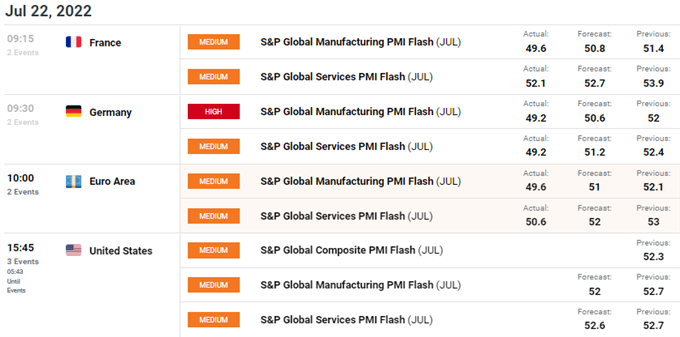

EZ Manufacturing PMI Flash (JULY) – ACT: 49.6; IS: 51EZ Services PMI Flash (JULY) – ACT: 50.6; IS: 52

THE EURO ON THE BACK FEET AFTER DISAPPOINTING THE PMI

The euro It started its decline today starting with missing French PMI estimates followed by German data which often serves as a barometer for the entire EU region. Unsurprisingly, EZ PMI followed suit (see economic calendar below), boosting the weaker euro. Manufacturing and services fell across all sectors, hinting at the negative impact of inflation on these respective sectors. Consumer spending appears to be on the decline recessive Fears are taking hold around the world as China, the world’s top importing nation, faces stifled economic activity that is having a systemic negative effect on European exports.

ECONOMIC CALENDAR EUR/USD

Source: DailyFX Economic Calendar

Later today, the focus will be on the US with its PMI data under scrutiny. Expectations are lower but still within the expansive zone. An in-line or above-forecast print could see EUR/USD move lower, while a miss will be interesting in terms of market reaction to the current EU PMI reaction.

FUNDAMENTAL CONTEXT OF THE EURO

Yesterday’s ECB interest rate However, the decision was welcomed by global markets, but the limiting factor to the rise of the euro comes from its recently named Transmission Protection Instrument (TPI) aimed at easing inflationary pressures (through higher borrowing costs) on the region. While the tool looks promising on the surface, the lack of details provided weighed on the euro and the region’s anxious nations. In particular, Italy bore the brunt of the ambiguity due to its political situation and widening 10-year BTP-Bund spreads. One positive relates to the unrestricted nature of the TPI as stated by the ECB, but until markets get more clarity, the euro is likely to remain under pressure.

Now that the ECB outlined a more data-centric view (removal of forward guidance), today’s market response to the PMI setup set EU inflation and next week. GDP releases with added interest.

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Picture made by Warren VenketasGI

Resistance levels:

Support levels:

IG CUSTOMER SENTIMENT DATA: MIXED

IGCS shows that retail traders are currently LONG activated EUR/USDwith 65% of traders currently holding long positions (as of this writing). At DailyFX we usually take a contrary view to crowd sentiment, but due to recent changes in long and short positioning, we are taking a cautious short-term bias.

Contact and follow Warren on Twitter: @WVenketas

element within element. Surely this is not what you wanted to do! Instead, you load your application’s JavaScript package inside the element.

[ad_2]

Source link