The Federal Wage Board has reported that federal wages still lag significantly behind the private sector, but this is not the only board update with the potential to affect pay for tens of thousands of federal employees.

Many of the task force’s recommendations focused on adding and expanding some different pay localities, as well as changing how many federal employees must be working in an area to qualify to establish a new pay…

READ MORE

The Federal Wage Board has reported that federal wages still lag significantly behind the private sector, but this is not the only board update with the potential to affect pay for tens of thousands of federal employees.

Many of the task force’s recommendations focused on adding and expanding a few different pay localities, as well as changing how many federal employees must work in an area in order to establish a new pay locality.

“These recommendations would result in approximately 32,950 General Schedule (GS) employees being reassigned from the ‘Rest of US’ to a separate locality pay area,” an Aug. 5 board document stated.

In particular, the council recommended adding a stipulation that any newly proposed paying locality must have an employment exchange rate of 7.5% for locations in metropolitan statistical areas (MSAs) and combined statistical areas (CSA). For areas that are not MSAs or CSAs, as well as locations surrounded by different payment localities, the council recommended establishing an interchange fee of 20%.

For a locality to count as an MSA, it must have at least an “urbanized area” of 50,000 or more residents, as defined by the Office of Management and Budget. CSAs are areas adjacent to MSAs.

The council, tasked with recommending annual adjustments to local pay for federal employees, met Aug. 5 and adopted input from a task force made up of leaders from several federal unions.

“These recommendations would put extra money in the hands of federal employees whose pay is being cut from their co-workers,” said American Federation of Government Employees national president Everett Kelley, a member of the council’s task force. , in one Press release of August 5.

The board also recommended removing the lower limit of having at least 2,500 GS employees in a given area to be considered a paying locality. Altogether, the recommendations would have the potential to move approximately 15,400 GS employees from the “Rest of the US” locality to a separate pay locality.

Another task force recommendation the board adopted followed an update OMB made to its MSA and CSA map. The new recommendation would add areas previously included on the map to the updated map and not remove areas not included on the updated map.

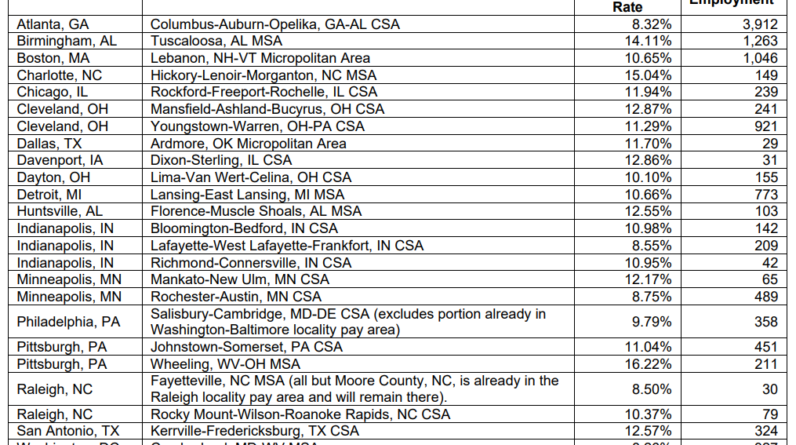

Other board recommendations would add the following areas to existing pay localities, affecting nearly 11,600 GS employees:

From the report of the working group of the Federal Wages Council

Here you can find all the recommendations of the City Council.

None of the recommendations, however, are definitive. First, the President’s Paying Agent, a three-person panel made up of leaders from the Department of Labor, the Office of Personnel Management and OMB, must consider and approve the recommendations.

The Federal Wage Board did not make a recommendation last year, because at the time, President Joe Biden had not yet chosen candidates for the three politically appointed seats on the board. In March, Biden nominated three council members, including Stephen Condrey to serve as chairman. Condrey previously served as former President Barack Obama’s council chair from 2010 to 2017. The other two appointed members are Janice Lachance, former OPM director, along with Jared Llorens.

Where does local payment come from?

Each year, GS employees receive two salary adjustments: one for base pay and one for local pay.

In 1990, Congress passed the Federal Employee Pay Comparability Act (FEPCA), which sought to eliminate a growing wage gap between non-federal and civil service wages. Paying locations are currently divided into 53 areas of the country, along with a “Rest of US” category.

FEPCA authorized the implementation of the full wage increase that is needed to reduce the wage gap between federal and non-federal wages to a 5% difference. But neither previous administrations nor the current administration have ever adopted the full wage adjustments FEPCA allows.

The council calculates pay disparity based on wages alone, with the most recent gap showing that federal employee pay lags the private sector by 22.47 percent, on average. But some economists, as well as the Congressional Budget Officehave said that when the value of benefits is considered, federal employees actually receive more than their non-federal counterparts.

Rather than going by the cost of living for a given location, locality pay changes are based on information from the Bureau of Labor Statistics, which measures non-federal versus federal wages in a specific labor market, for employees who do similar work. area

The Federal Wage Council makes recommendations each year to adjust the breakdown of pay locations for GS employees. The President’s Paying Agent then reviews the recommendations and determines whether to implement them.

Biden did not specify the breakdown of the proposed federal wage increase for 2023, but typically, 0.5% of the total percentage is set aside for wage locality adjustments. If this is true, it means that the general proposal of 4.6% would indicate a base salary increase of 4.1%, plus 0.5% spread over local pay.

[ad_2]

Source link