The Federal Reserve raised interest rates this afternoon by 0.75%, the second consecutive increase of this caliber. The move was widely expected as the Federal Reserve continues its efforts to fight inflation.

In a statement, the Fed said: “Recent indicators of spending and output have softened. However, job gains have been robust in recent months and the unemployment rate has remained low. Inflation remains elevated, reflecting pandemic-related supply-demand imbalances, higher food and energy prices, and broader price pressures.”

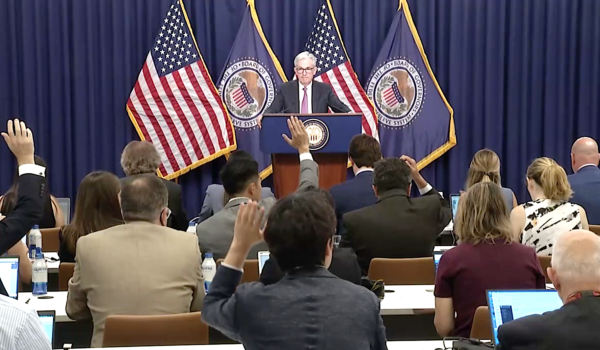

Fed Chairman Jerome Powell at the July 27 press conference.

The Federal Reserve also cited Russia’s war against Ukraine as causing enormous human and economic hardship, as well as creating additional upward pressure on inflation.

The Federal Reserve said it is looking to reduce inflation to 2%, while the annualized inflation rate has been just over 9%.

“The Committee is strongly committed to returning inflation to its 2 percent target,” the Federal Reserve said.

At 2:30 p.m., Fed Chairman Jerome Powell, in a press conference, indicated that there will be additional rate hikes this year, but they likely won’t be in the 0.75% range. He predicted “below trend” economic growth for the future.

“Over the coming months, we will be looking for compelling evidence that inflation is coming down so that inflation returns to 2 percent,” Powell said. “We anticipate that continued increases in the federal funds rate will be appropriate.”

Fed Chairman Jerome Powell at the July 27 press conference.

Fed Chairman Jerome Powell at the July 27 press conference.

Powell said the economy has likely not yet felt the full effect of the two recent 0.75% rate hikes and that the Fed believes another unusually large rate hike could be appropriate for September. but that the Fed is having a “meeting”. by meeting” approach now. He said right now there is more uncertainty than usual about where the economy may be headed.

“The committee sees more rate increases in 2023,” Powell said. “We believe it is necessary to have a slowdown in growth. Price stability is the basis of the economy.”

Powell said he does not believe the U.S. is currently in a recession and there is evidence of that because of the economy’s performance. He said there is a very strong labor market and that in itself argues against the economy being in recession.

“Over the coming months, we will be looking for compelling evidence that inflation is moving lower, so that inflation returns to 2%,” Powell said. “We expect continued increases in the target range for the federal funds rate to be appropriate; the pace of these increases will continue to depend on incoming data and the evolving outlook for the economy. Today’s increase in the target range is the second increase of 75 basis points in as many meetings. While another unusually large increase could be appropriate at our next meeting, that is a decision that will depend on the data we get between now and then.” .

[ad_2]

Source link