EUR/USD COMMUNICATION POINTS

EZ Services PMI (JULY) – ACT: 51.2; IS: 50.6Italian and German PMIs turn negative!

FUNDAMENTAL CONTEXT OF THE EURO

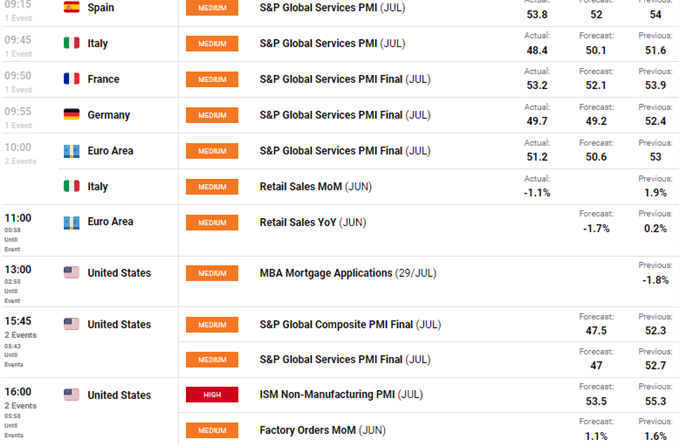

The euro held against the greenback this morning after an assortment of Eurozone services PMI data hit the economic calendar (see below). We saw worrying signs from both Italy and Germany now entering contractionary territory (below 50) driven primarily by rising energy and food costs. This affected demand for services and does not appear to be abating anytime soon as energy concerns persist. Overall, the eurozone impression beat estimates 51.2 which left the euro supported after yesterday’s dollar strength.

ECONOMIC CALENDAR EUR/USD

Source: DailyFX Economic Calendar

Globally, the main driver of global markets comes from Nancy Pelosi’s visit to Taiwan, which has been met with disdain by China, which has since announced its plan to conduct military exercises around and possibly over Taiwan while blocking major waterways to Taiwanese ports. Some exports to Taiwan from China have also stopped, leaving the euro vulnerable as investors seek safety through the green bill.

US PMIs will be in focus later today with lower forecasts than June. It’s important to note that the US is primarily a service nation, so this release should serve as a good barometer for the economy under the current Federal Reserve voltage cycle. Also, the fact that the Fed has become more “data dependent” could see a bigger market reaction USD you believe

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Picture made by Warren VenketasGI

Resistance levels:

Support levels:

IG CUSTOMER SENTIMENT DATA: MIXED

IGCS shows that retail traders are currently LONG activated EUR/USDwith 63% of traders currently holding long positions (as of this writing). At DailyFX we usually take a contrary view to crowd sentiment, but due to recent changes in long and short positioning, we are taking a cautious short-term bias.

Contact and follow Warren on Twitter: @WVenketas

element within element. Surely this is not what you wanted to do! Instead, you load your application’s JavaScript package inside the element.

[ad_2]

Source link