STERLING CONVERSION POINTS

Recessionary reserves hurt GBP.50 bps is not enough to support the cable up.

FUNDAMENTAL CONTEXT GBP/USD

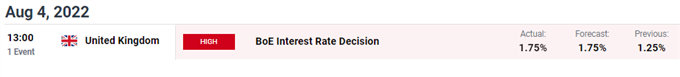

The Bank of England (BoE) interest rates were expected to rise 50 bps derived mainly from the international pressures of the Federal Reserve and more recently some ECB speakers. ECB Kazaks announced that the ECB it would have to keep raising rates to keep up with inflation.

ECONOMIC CALENDAR GBP/USD

Source: DailyFX Economic Calendar

INFLATION FORECASTS

At the inflation First, the October 2022 forecast has been revised higher from 11% to 13.3%, while the BoE forecasts a recession in 4Q 2022 for a duration of 5 quarters. With the highest interest ratepressure on the consumer will increase especially in the mortgage space, as will its effect on retail sales and consumer spending.

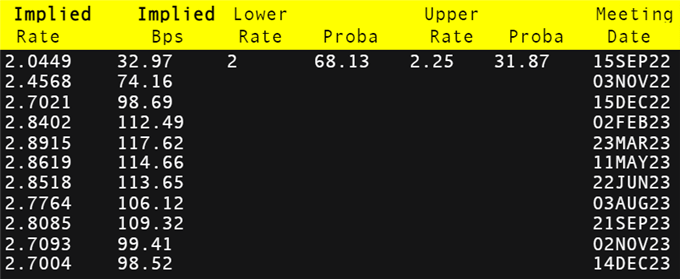

Looking ahead, money markets still expect further rate hikes, but with the constant threat of an energy crisis and fears of a global recession could see a rapid reduction in rate hikes, which is feasible given that the BoE was the first major central bank to raise rates.

BOE INTEREST PROBABILITY

Source: refinitive

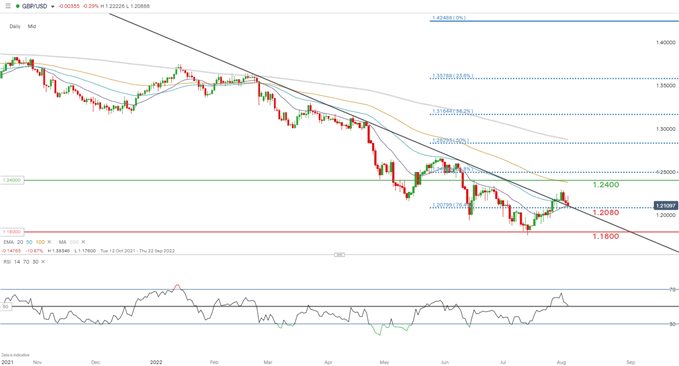

TECHNICAL ANALYSIS

GBP/USD DAILY GRAPH

Picture made by Warren Venketas, GI

GBP/USD Daily price action reacted negatively to the news. I guess this is mostly from the recession declaration, but a backlash to a 50bp hike has not been uncommon around the world. This pound is certainly trending lower as external global factors grow in influence.

Key resistance levels:

1.2400/100 day EMA (yellow)50-day EMA (blue)

Key levels of support:

1.2080/20-day EMA (purple)

MIXED FEELING FROM THE IG CUSTOMER

IG Customer Sentiment Data (IGCS) shows that retail traders are currently LONG activated GBP/USDwith 70% of traders currently holding long positions (as of this writing). At DailyFX we usually take a contrary view to crowd sentiment, but due to recent changes in long and short positions, we are taking a cautious short-term bias.

Contact and follow Warren on Twitter: @WVenketas

element within element. Surely this is not what you wanted to do! Instead, you load your application’s JavaScript package inside the element.

[ad_2]

Source link