WASHINGTON – Senate Democrats approved a sweeping economic and climate package on Sunday, putting President Joe Biden and his party on the cusp of a major legislative victory just three months before crucial midterm elections in November.

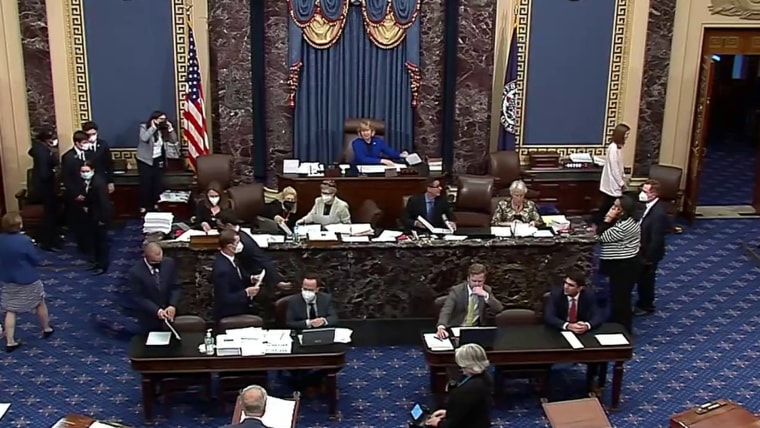

After a marathon overnight Senate session, the 51-50 vote was strictly along party lines, with all Republicans voting no and all Democrats voting yes. After Vice President Kamala Harris cast the tie-breaking vote, Democrats stood and applauded.

The legislation, called the Inflation Reduction Act, now heads to the House, which plans to return from its summer recess on Friday, pass the legislation and send it to Biden’s desk for his signature.

“It’s been a long, hard, and winding road, but we’re finally here. I know it’s been a long day and a long night. But we made it today,” Senate Majority Leader Chuck Schumer told the chamber of the Senate before the final vote.

“After more than a year of hard work, the Senate is making history. I am confident that the Inflation Reduction Act will live on as one of the defining legislative feats of the 21st century.”

The 755-page bill includes $430 billion to fight climate change and expand health coverage, paid for by savings on prescription drugs and corporate taxes. Invest hundreds of billions of dollars in deficit reduction.

Most of the spending, more than $300 billion, covers investments to tackle climate change and boost clean energy, including incentives for farmers and ranchers to reduce methane emissions; an extension of the tax deduction for electric vehicles; and the launch of a National Climate Bank that would invest in clean energy technologies and energy efficiency. The legislation would allow Medicare to negotiate prices with drug companies for the first time, reducing prescription drug prices for people 65 and older. The savings would help pay for a three-year extension of Affordable Care Act subsidies, which would avert an expected increase in insurance premiums that was set to take effect in 2023. The package includes a cap to the price of insulin for the 65 year old. and older on Medicare, but Republicans successfully removed a $35 cap on insulin on the private market. The bill also raises revenue through a new 15% minimum tax on large corporations, although accelerated depreciation would be exempt, a key question from centrist Senator Kyrsten. Sinema, D-Ariz., who pulled several tax changes from the leadership before joining the pack. Sinema also successfully eliminated a provision to close the interest tax loophole that benefits hedge fund and private equity managers. It was replaced, with Sinema’s support, by a 1% special tax on share buybacks that actually generates more revenue than the interest provision would.

Legislation quickly came together. Less than two weeks ago, Senate Majority Leader Chuck Schumer, DN.Y., and Sen. Joe Manchin, DW. Va., announced a surprise deal on some of the party’s top agenda items that many Democrats believed had no chance of becoming law this year.

Chuck Schumer, Joe Manchin.AP

Chuck Schumer, Joe Manchin.AP

Democrats see the expansionary package as the latest in an unusual streak of legislative victories for a Congress that is typically mired in partisan gridlock. Last year there was a trillion dollar infrastructure package, the most important gun control legislation in a generation, a major semiconductor and science competitiveness package, a bill to help the veterans exposed to burn pits and a vote to admit Finland and Sweden to NATO amid a standoff. with Russia

“Mitch McConnell and the Republicans have been with Big Oil, with Big Pharma to protect their profits, and we’ve been trying for years” to cut costs, Sen. Debbie Stabenow, D-Mich., head of the Democratic Policy Committee, told the NBC News.

“This is the big time here with these forces,” he said, “and the people will win.”

Sen. Cory Booker, DN.J., a progressive challenger and a former 2020 presidential challenger to Biden, also pointed to recent developments in Congress.

“I don’t know if there’s been a Congress and a president that has been as productive as we’ve seen in this Congress,” he said in an interview. “This president continues to introduce historic bills that meet the urgent needs of the American public.”

Sen. Gary Peters, D-Mich., campaign chairman for Senate Democrats this cycle, said the reconciliation package makes his job easier as he tries to protect incumbents and grow his party’s fragile majority.

“Reducing drug prices, lowering the cost of health insurance for millions of Americans, dealing with climate change motivates our base in a big way, especially young voters,” Peters said. .

Republicans could do little to stop the massive spending package. They couldn’t filibuster it, since Democrats are using the special budget reconciliation process that allows them to pass a bill with a simple majority, without needing the support of a single Republican.

But Republicans found ways to make things painful. During the “vote-a-rama,” a process in which senators can offer virtually unlimited amendments, Republicans late Saturday night and into Sunday morning forced vulnerable Democrats into tough vote after tough vote on issues politically complicated.

Sen. John Barrasso, R-Wyo., offered an amendment to lower gas prices by increasing domestic energy production, while Sen. James Lankford, R-Okla., offered one that would provide additional funding for the implementation of Title 42, the controversial public health rule that blocked asylum seekers trying to cross the border. But Democrats held together and defeated nearly all of the GOP amendments.

The pack faced turbulence near the end of the vot-a-rama. Sinema and six other centrist Democrats helped pass a Republican amendment that would exempt some subsidiaries owned by private equity firms from the new minimum corporate tax. The amendment could have created a major problem in the House, as it was paid for by expanding the limit for state and local tax deductions (SALT), which was opposed by Democrats in the Northeast.

But Democrats came up with a creative solution: Sen. Mark Warner, D-Va., offered a substitute amendment, replacing the SALT payment with an extension of the two-year loss limitation that held together the fragile Democratic coalition .

In speeches and interviews on the aisle, Republicans argued that the bill’s name was misleading and that it would do little to reduce record inflation under Biden.

Senate Minority Leader Mitch McConnell, R-Ky., blasted it as “another reckless tax-and-spend game.” And Senate Minority Whip John Thune, RSD, called it “The Democrats’ Bag of Bad Ideas.” Others said the hundreds of billions in corporate tax increases would push the country into recession.

“I think we’re in the early stages of stagflation. And the worst thing you can do in the early stages of stagflation is to slow down the economy even more, which … the new taxes will do,” said the Senator John Kennedy, Republican of La.

“If they want to celebrate a tax-and-spend, job-killing, wasteful bill at a time when inflation is high, I think their celebration is misplaced,” said Sen. Cynthia Lummis, R-Wyo. ., adding that she was “disappointed” that her moderate Democratic colleagues got on board despite acknowledging that Americans are struggling with high prices for gas, groceries and travel.

Some criticism also came from the Democrats’ own caucus. Sen. Bernie Sanders, I-Vt., the progressive icon who caucuses with Democrats, ripped the package for not going far enough. Unlike Biden’s original Build Back Better package, the inflation-reduced bill had no child tax credits, universal preschool, free community college or Medicare expansion.

“There is no one who can deny that this legislation does not address the major crises facing working families,” Sanders told reporters. “This bill has nothing to say about the housing crisis, the child care crisis, the higher education crisis, the crisis of millions of Americans. Older Americans have no teeth in the mouth because we haven’t expanded Medicare.”

[ad_2]

Source link