Eurozone and German GDP drag down EU assets

German GDP stagnates, the EU confirms the slowdown in growth. EUR/USD pulls back on warmer US inflation data amid weaker growth outlook, but bullishness remains in tactDAX but has weakened significantly on bearish fundamentalsThe analysis in this article makes use of graphics patterns and key support and resistance levels For more information visit our complete education library

Recommended by Richard Snow

Get your free Euro forecast

German GDP stagnates, EU GDP reveals slowing growth

Germany’s first-quarter GDP data narrowly avoided a contraction as the first three months of the year posted a 0% improvement from the fourth quarter of 2022, according to Friday morning’s flash estimate . The print is significantly lower than consensus estimates for growth of less than 0.3%, which carries EU-related assets decisively.

The broader euro area economy fared slightly better, but also missed estimates on both quarter-on-quarter (QoQ) and year-on-year (YoY) benchmarks. The year-on-year growth of 1.3% represents a decrease of 0.5% compared to the 4Q statistic, continuing the deceleration of growth.

Customize and filter live economic data using our DailyFX economic calendar

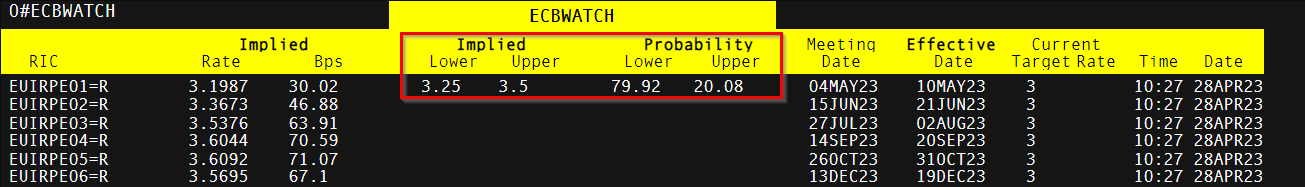

The disappointing data has caused rate expectations to shift further in favor of a 25 basis point (bp) hike when the ECB’s governing council meets next week on Thursday, with an outside possibility of 50bp looking less likely . Markets currently see an 80% chance of a 25 basis point increase next week.

ECB interest rate Probabilities (implied)

Source: Refinitiv, prepared by Richard Snow

Recommended by Richard Snow

Learn how to prepare for market movement data

EU assets fall after disappointing growth data

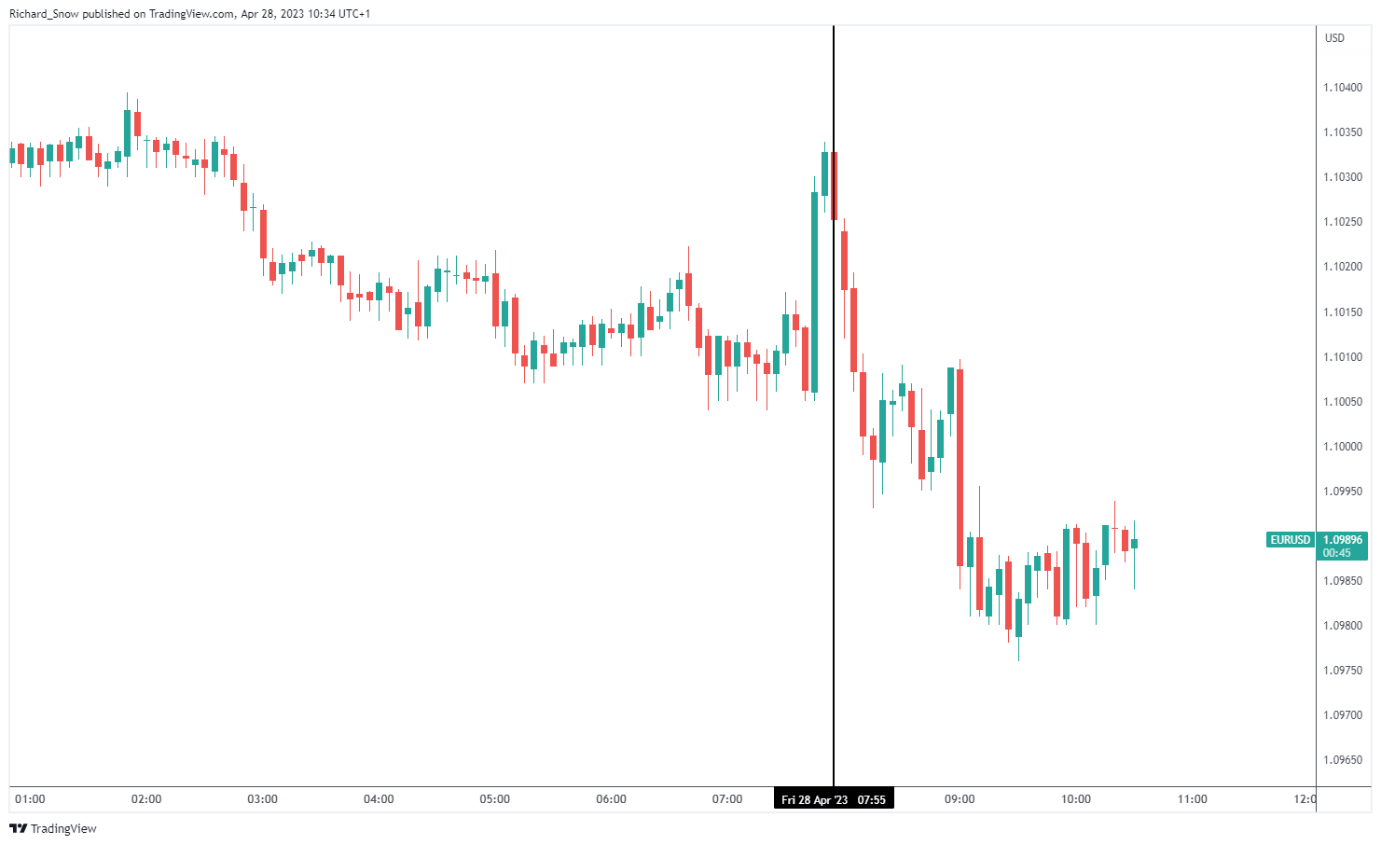

EUR/USD immediately headed lower after the German data, but consolidated in the moments after the EU data scrolled across the computer screens.

EUR/USD 5 minute chart

Source: TradingView, powered by Richard Snow

The recent move lower has been spurred by weaker-than-expected growth data from Germany, along with a rare boost from the dollar as yesterday’s inflation component of first-quarter US GDP. The print came in hotter than expected, adding more weight behind the general consensus we’ll see a 25 basis point hike next week from the FOMC.

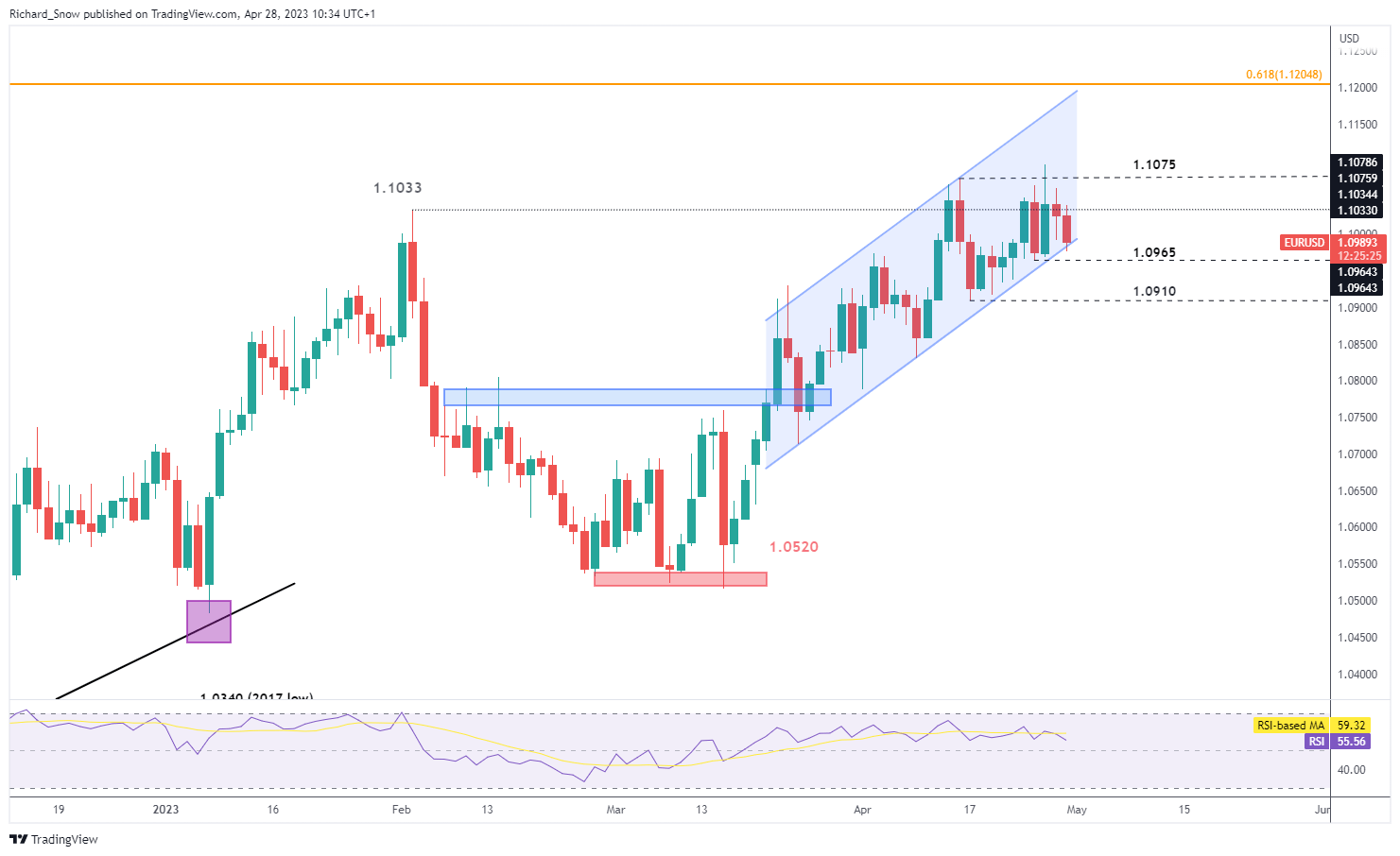

The long-term uptrend remains bullish as prices remain within the ascending channel for now. Indeed, this pullback will be welcomed by EUR/USD touches anticipating a pullback before considering a bullish continuation.

EUR/USD Daily Chart

Source: TradingView, powered by Richard Snow

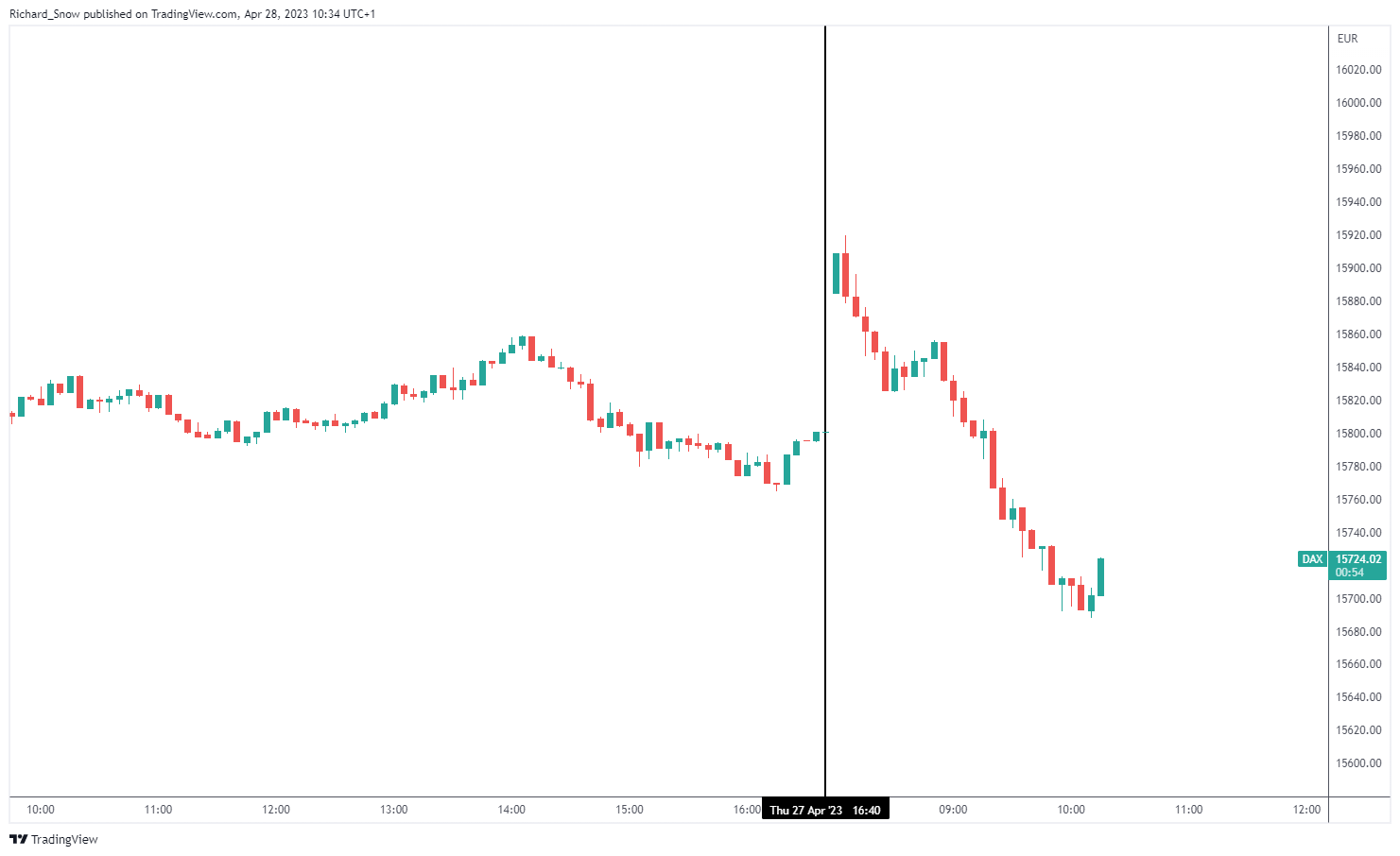

The DAX index also declined after the German growth data according to the 5-minute chart below, despite a gap higher at the open. The index had already shown signs of bullish fatigue on the daily chart as it struggled to advance from a yearly high.

DAX 5 minute chart

Source: TradingView, powered by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element within element. Surely this is not what you wanted to do! Instead, you load your application’s JavaScript package inside the element.

[ad_2]

Source link