ISM non-manufacturing (services) PMI misses estimate

The second of two measures assessing the health of the US economy added to concerns that the relatively strong US economy is showing signs of concern. The ISM non-manufacturing PMI data came in at 51.2 versus expectations of 54.5 and a prior print of 55.1 in February.

Customize and filter live economic data using our DailyFX economic calendar

Worrying signs are emerging for the US economy

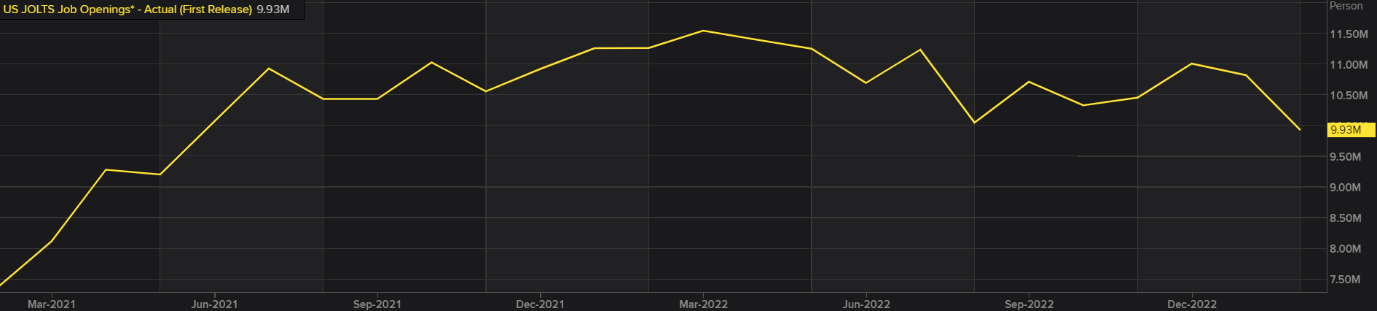

The disappointing US services data comes after ISM manufacturing data slipped further into contractionary territory (46.3 from 47.7 in February), ADP employment data declined (145k vs. 242 in February) and US job openings fell from 10.824 million to 9.931 million. While the earlier data likely reflects the uncertainty surrounding banking instability for most of March, the softer data across the board means this is certainly something that deserves more attention if recession worries are to pick up from here.

Refinitiv font

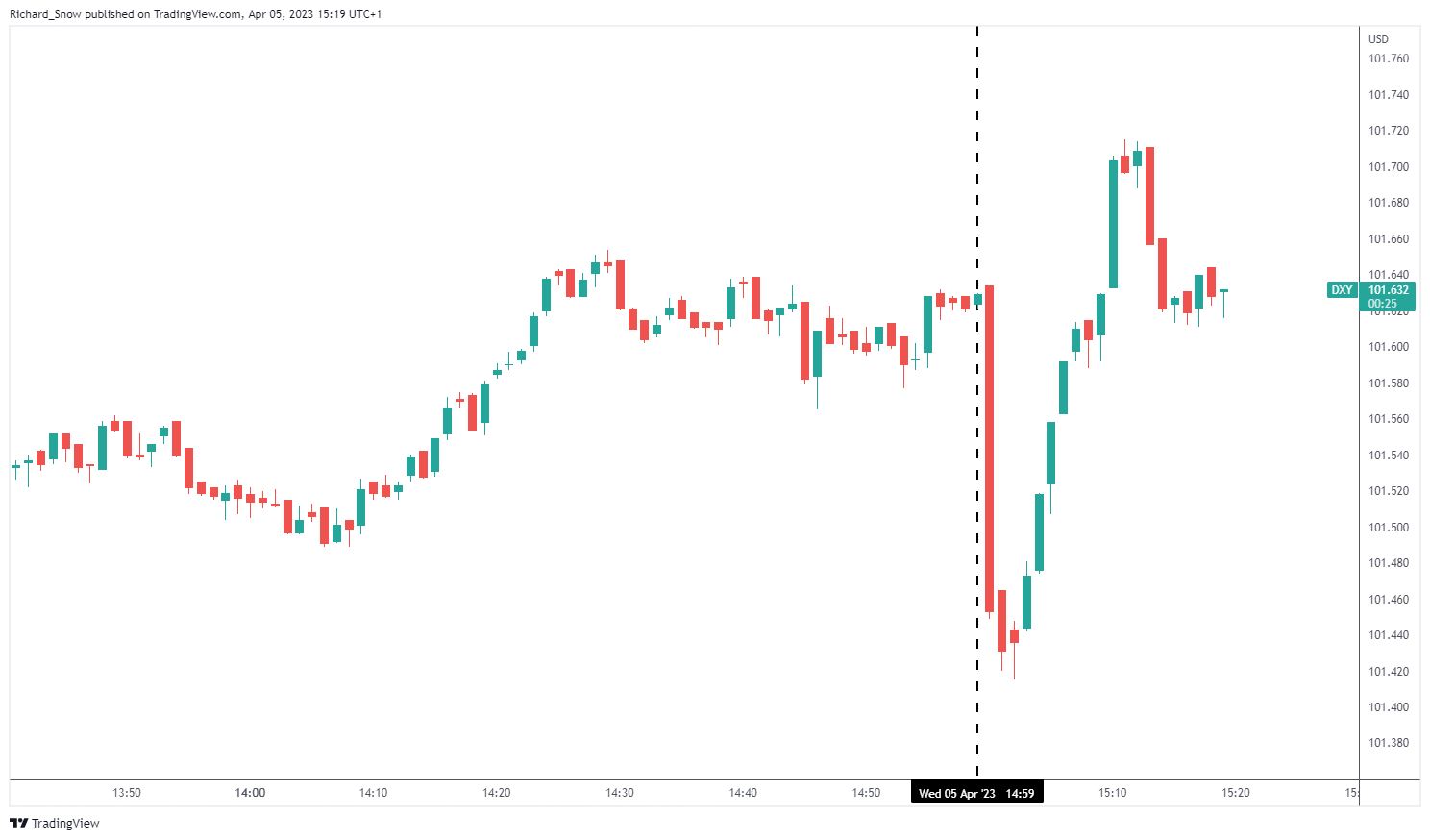

dxy (basket of US dollars)

The dollar staged a recovery after initially falling in the moments after the data release. The US dollar is likely to engage in a tug-of-war as the market’s growing expectations of rate cuts in the second half keep the greenback suppressed, while on the other hand , the greenback still has safe-haven appeal (as data softens) and may rise on more dovish rhetoric from Fed officials.

source: TradingView

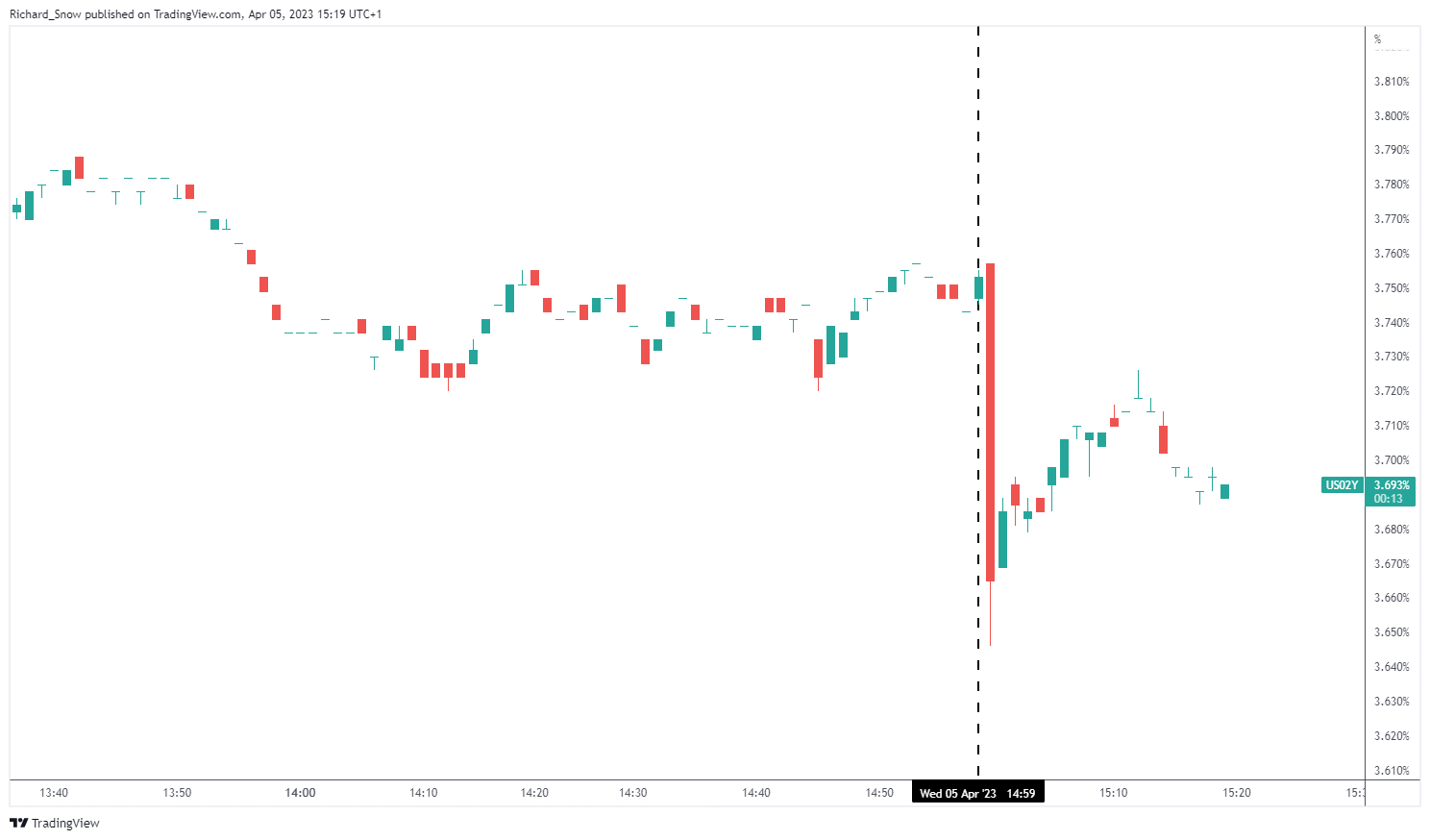

US 2-year yields

Rates on the shorter side of the yield curve, such as the US dollar, saw an immediate drop, but it differs from the dollar’s response in that it has so far failed to recover to levels seen before the data release .

source: TradingView

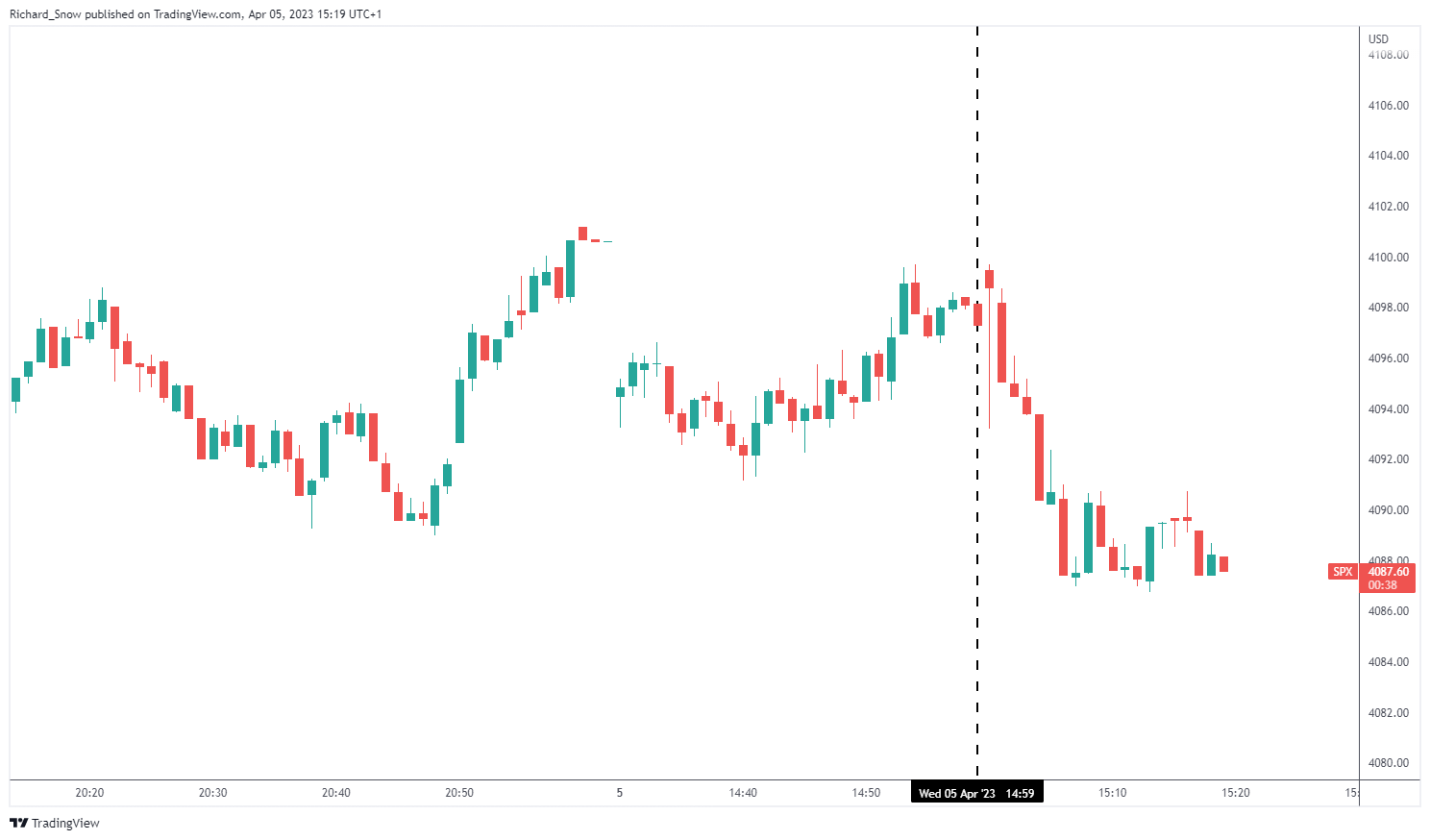

S&P 500

The S&P500 edged lower after the release of the ISM services data, setting the index on course for a second day of declines. Prior to that, US stocks were in a fairly bullish phase, rising as risk appetite returned to the market as the Fed’s recent supportive measures eased concerns about US regional banks .

Next on the calendar are US initial jobless claims, given softer employment data this week, and US non-farm payrolls on Friday, which fall on a holiday, which means that the potential for highly volatile moves remains a possibility given the lower expected liquidity. .

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element within element. Surely this is not what you wanted to do! Instead, you load your application’s JavaScript package inside the element.

[ad_2]

Source link