Being part of a blended family can certainly be rewarding. Of course, as with all families, there will be challenges, one of which is financial. A blended family has to deal with some specific financial issues, so it’s a good idea to familiarize yourself with them.

In particular, consider these areas:

Separate or joint accounts? – Should your two family units combine all of your finances or keep separate accounts? There is no right answer for everyone, because this issue has emotional and psychological components as well as financial considerations. But the nature of your new blended family may guide you to a choice that makes sense for your situation. So, for example, if you remarry later in life and you and your new spouse have adult children, you might think it’s best to keep separate accounts. But if you’re joining households with a spouse or partner with younger children, you may want to merge accounts to pay for household expenses and work toward your new, shared financial goals. And it doesn’t have to be an “either” approach; you may decide to combine some accounts and keep them separate.

Debts and Credit Ratings – Chances are you and your new spouse or partner, and maybe even some children, will bring debt to your blended family. Because these debts can affect your family’s finances in a number of ways, including your ability to borrow and your credit ratings, you’ll want to know what everyone owes and the amount of monthly payments needed to meet those obligations. After that, you may be able to find ways to consolidate your debts or find other ways to reduce or eliminate them.

Legal issues – When you start a blended family, you may want to review and possibly update beneficiary designations on your life insurance policy and retirement accounts, such as your IRA and 401(k). These designations can supersede any instructions you’ve left in your estate planning documents, including your last will and testament, so it’s important to make sure they reflect your current wishes. And speaking of your estate plans, you may need to review those as well, in consultation with your attorney.

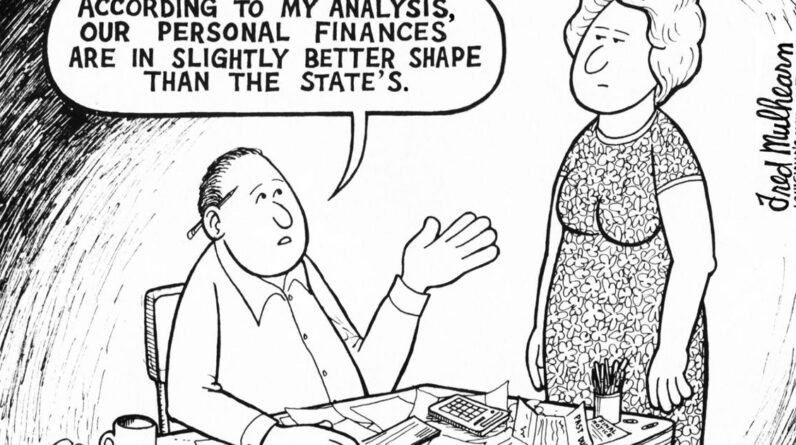

Attitudes towards money – Attitudes toward money—yours and your new spouse’s or significant other’s—must be considered when creating a blended family. Is one of you more of a saver while the other is more of a spender? As investors, is one of you more risk-averse while the other is more conservative? It is important to reconcile these differences as best as possible, especially if you plan to merge your finances. This means that both of you will have to compromise a bit, but you should try not to make either of you uncomfortable with your choices. In any case, open and honest communication is the first step to achieving a harmonious financial strategy.

These aren’t the only financial considerations related to blended families, but they should give you some food for thought, and the sooner you start thinking about it, the better.

Jennifer Barrett (AAMS) is a local financial advisor at Edward Jones.

225-612-0413 | jennifer.barrett@edwardjones.com

Edward Jones. SIPC member.

Edward Jones, its employees and financial advisors are not estate planners and cannot provide tax or legal advice. You should consult your estate planning attorney or qualified tax advisor regarding your situation.

This article was written by Edward Jones for your local Edward Jones Financial Advisor.

[ad_2]

Source link