German CPI/IPCA Pace Estimates

German inflation rises in all measures during the month of June. The ECB is likely to remain dovish due to stubborn inflation. The euro will continue to be supported. Surprising US GDP data lifts dollar, sending EUR/USD sharply lower moments after releaseThe analysis in this article makes use of graphics patterns and key support and resistance levels For more information visit our complete education library

Recommended by Richard Snow

Introduction to Forex News Trading

German inflation rises in all measures in June

CPI in Germany beat last months 6.2% and the consensus estimate of 6.3% to print at 6.4%, ending the downward trend in headline inflation that has developed throughout the year. The most broadly comparable measure within the eurozone, the IAPC also revealed a warmer month-on-month impression, coming in at 6.8%, which was either in line or slightly above expectations, depending on the source of the survey data used. Either way, the higher impression will only encourage Christine Lagarde and the rest of the governing council as they continue to talk about future rate hikes.

Customize and filter live economic data using our DailyFX economic calendar

Today’s German data tends to weigh on the broader EU inflation data due tomorrow, potentially adding a bigger-than-expected impression. As inflation continues to be under discussion this week, after the EU inflation data tomorrow we will have the US PCE data, the Fed’s preferred measure.

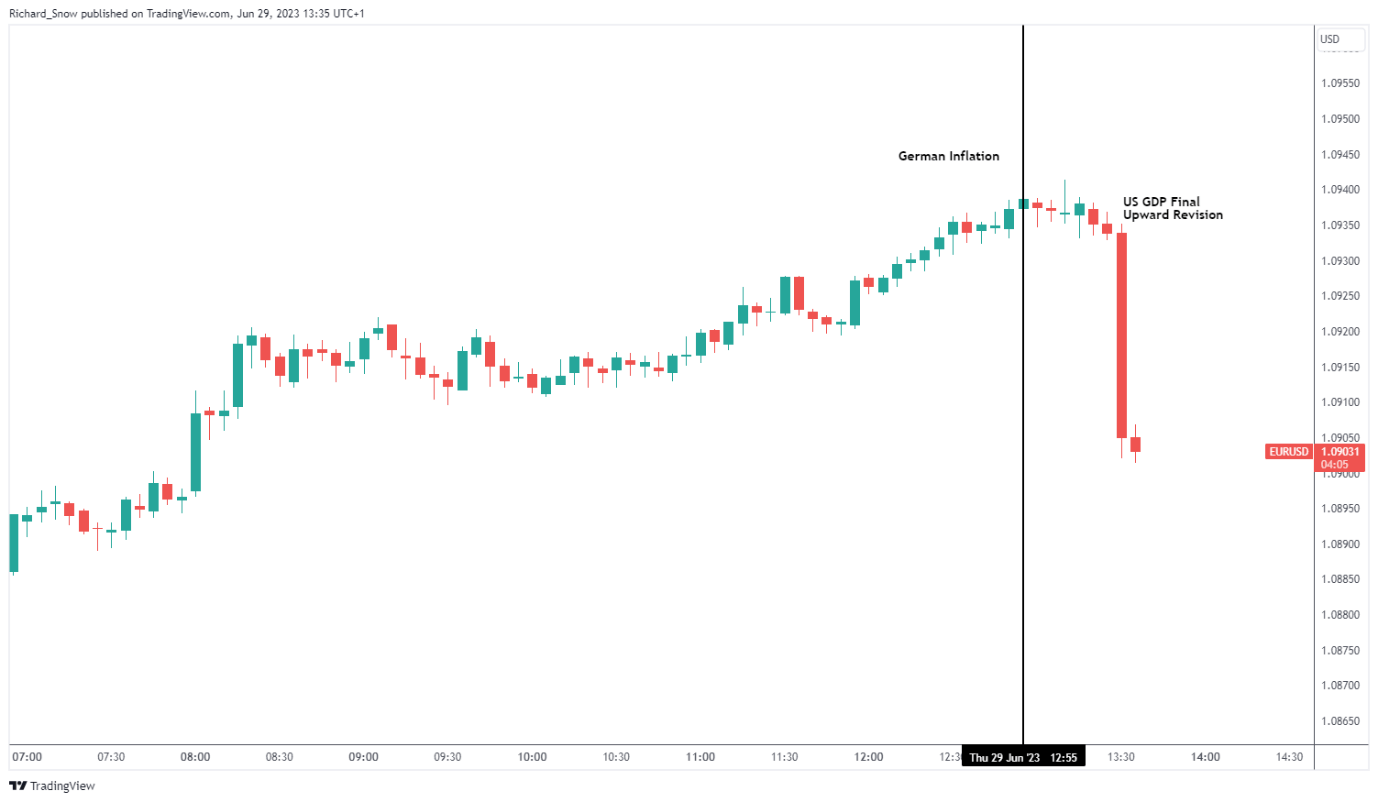

Immediate market reaction

The immediate reaction of the euro was rather soft, given that prices had risen in anticipation of the date. 30 minutes later, however, a massive upward revision to the final US GDP figure for the first quarter saw the dollar rise, sending EUR/USD lower.

EUR/USD 5 minute chart

Source: TradingView, powered by Richard Snow

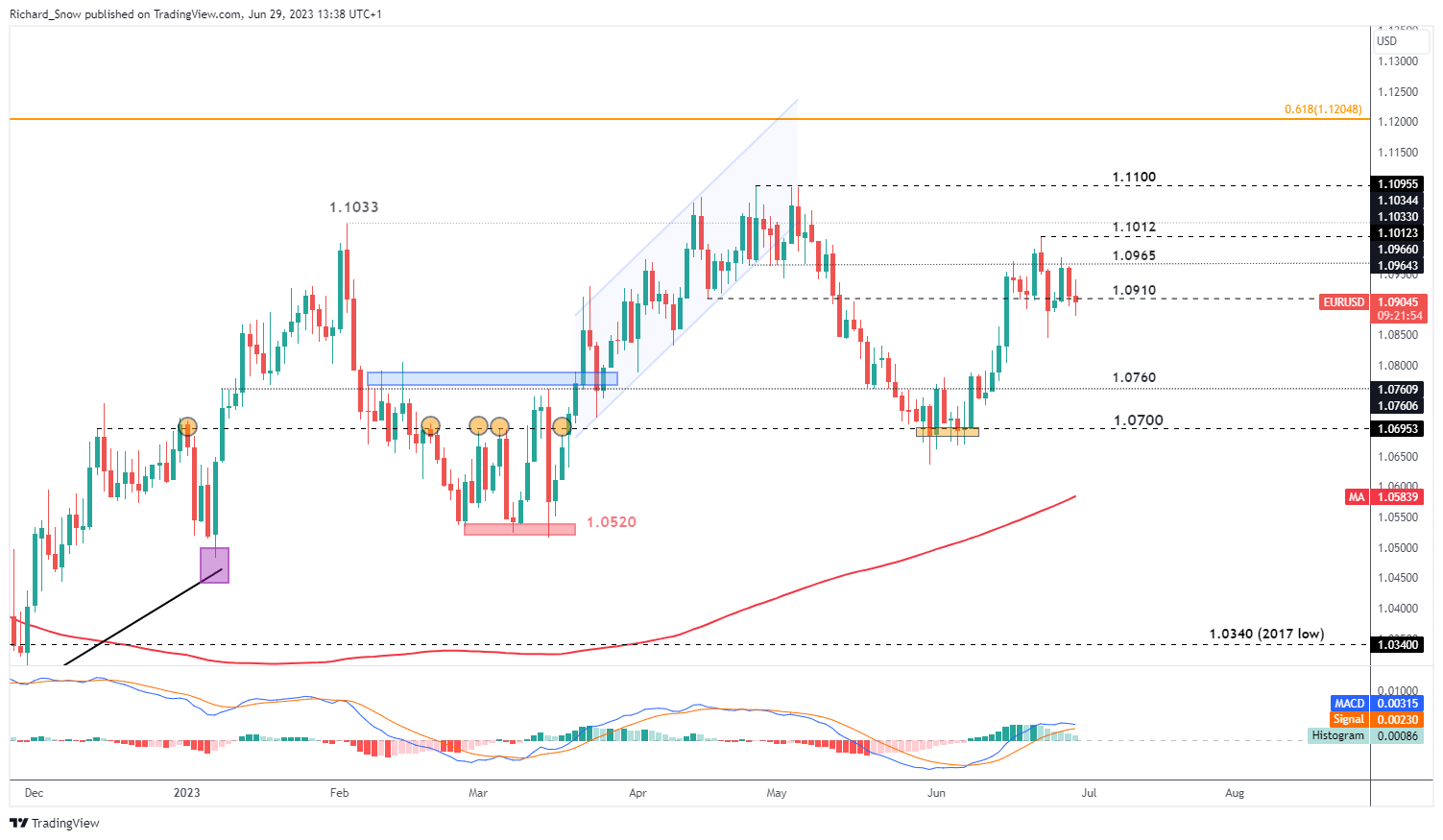

The US data has influenced the intraday trade seen on the daily chart, moving from positive to negative as prices trade below 1.0910 at the time of writing.

EUR/USD Daily Chart

Source: TradingView, powered by Richard Snow

Trade Smarter – Sign up for the DailyFX newsletter

Receive timely and compelling market feedback from the DailyFX team

Subscribe to the newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element within element. Surely this is not what you wanted to do! Instead, you load your application’s JavaScript package inside the element.

[ad_2]

Source link