Microsoft will include Azure-related roles in its recently announced reduction of 10,000 employees, according to the report of The information. Today, Microsoft CEO Satya Nadella confirmed rumors of layoffs, saying the company will incur $1.2 billion in costs related to downsizing.

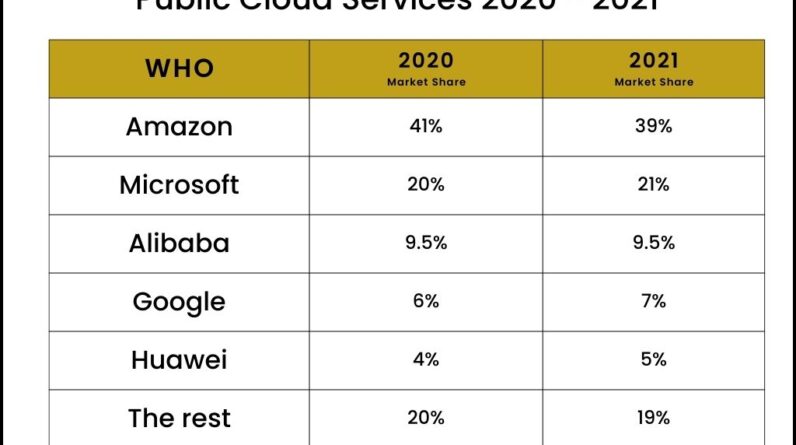

This move by the cloud service provider (CSP) giant aligns with signs of slowing demand for cloud services, as evidenced by a downgrade by UBS, competitors such as AWS reporting slower growth and strong reviews of cloud service pricing. While most price criticism is reserved for AWS, Azure’s main competitor, Azure, has at times been linked to such complaints.

When asked directly about the impact the layoffs will have on its cloud division, Microsoft pointed us to Nadella’s statement confirming the reductions. “We have nothing further to share the blog at this time,” said a Microsoft representative.

In his blog post, Nadella said the $1.2 billion will include “above-market” compensation packages, changes to the company’s hardware portfolio and reduced office rents “to create a greater density in our workspaces.” This means that Microsoft will have fewer employees, but they will be closer.

The layoffs blow the popular belief that data center jobs are “safe” from market forces because they are so close to providing technology services.

“There are multiple groups within any large CSP that support all aspects of development and operations, and they are not immune to selective layoffs,” said Alan Howard, senior analyst at Omdia. “It’s an area that’s arguably more secure than other business support areas because of the nature of supporting business-critical workloads.”

The report reports that the Azure cuts will be focused on business development sales support within a team led by Omar Abbosh, Microsoft’s corporate vice president of Industry Solutions.

Some may wonder what will happen to Azure-hosted workloads in light of the layoffs. Will it be wise to start a migration to another CSP or move to a colo?

Repatriate your workloads? This is what a company is doing

37signals made an amazing announcement about leaving the cloud in October, and followed up that post last week with some more details. Last week’s post by Fernando Álvarez, senior reliability engineer at 37signals, said the company is working with an MSP as it allows its long-term contracts with AWS to expire. The MSP, Deft, offers white glove services in addition to traditional managed service offerings that 37signals believes will ease its IT costs.

The company seems to be looking to retain the benefits of the cloud without managing it or paying a premium for it. It should be noted that Deft is an AWS Partner for Managed Services. One wonders, however, once their workloads are fully migrated, whether the cost savings will be enough to justify the expense of the move.

37signals cloud spending in 2022 reached $3,201,564. This is all on AWS services for two of their products, Basecamp, which is a project management platform, and HEY, which is a messaging platform. This also includes legacy products.

What we often wonder is whether companies have done the data center math when considering repatriating workloads. 37signals’ move to work with an MSP/AWS partner could be the magic bullet, but the company has yet to provide pricing around the switch. Some line items they will incur include:

Hardware Rackspace Bandwidth Power White Glove Service

This approach could be less expensive with a white-glove MSP, as 37signals spends $266,797 per month on cloud services. The company does not make projections about rising costs as its long-term AWS contracts expire.

AI over Azure or AI with Azure?

It was also reported that Microsoft plans to include AI capabilities from OpenAI and ChatGPT in all of its products. During a meeting Tuesday at the World Economic Forum in Davos, Switzerland, Nadella said the company is looking to monetize OpenAI’s AI technology and Dall-E 2, the AI-powered image development technology.

As the growth of the cloud slows and the technology becomes integrated into every company’s technology toolbox, it seems that the company that takes advantage of the practical applications of AI wins the race for profitability.

Analysts believe this change indicates a continuation and evolution of the technology.

“It’s common to lose headcount in uncertain economic times,” says Howard. “But it’s also an opportunity to streamline areas that have gotten unnecessarily bloated over time … which big tech companies do periodically. [Microsoft] it will not stop hiring, but will focus on areas of higher demand that generate revenue.”

Today’s move shows that Microsoft is betting on AI powered by Azuregiving companies a quick and, one would think, affordable entry into leveraging AI technology at scale for profit/competitive advantage.

[ad_2]

Source link