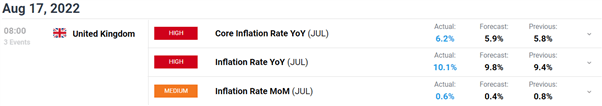

UK CPI Key Points:

The Yearly UK IPC Ror 10.1% Aannually, on top a cnonsense Fore of 9.8% and more from 9.4% in June.getting up Food price Mbye the Langry ulost ccontribution to Ayearly meinflation Reat between June and July.The Bank of England eexpectations meinflation a TOp Oto 13.3% in October.

CPI and Forex: How CPI data affects currency prices

uK inflation accelerated july bfood estimates and underscoring relentless price pressures. Impression increases squeeze consumers while adding to existing pressure for government and Bank of England action.

The consumer price index rose 10.1% in July from a year earlier after a 9.4% rise in the previous month, the Office for National Statistics said on Wednesday. Economists had expected a reading of 9.8%.The bank expects inflation to exceed 13.3% in October. Conservative Party leadership candidates Liz Truss and Rishi Sunak, one of whom will succeed Boris Johnson as Prime Minister on September 5 following a poll of party members, are under increasing pressure to deliver radical solutions to the crisis country’s cost of living history.

Customize and filter live economic data using ourDailyFX Economic Calendar

The Bank of England is in a difficult spot like the US Federal Reserve continues his hiking cycle. Rising energy prices are one of the main reasons why the inflation rate is so high. The Russian invasion of Ukraine has led to more significant increases in the price of gas. Since May, the price of gas has doubled. According to BoE estimates these price hikes will further increase inflation in the coming months, to around 13%.

Economists are increasingly pessimistic about the UK, with the risk of a recession now seen as much more likely than not and interest rates expected to be higher than previously thought. The inflation impression comes behind yesterday’s UK employment data for July what was a bit of a mixed bag.Vacancies in the UK fell for the first time since August 2020 with real salary ddeclining at the sharpest pace on record, indicating a stronger inflationary squeeze on consumers and businesses. looking ahead the outlook is less bright, with the BOE forecasting unemployment to rise above 6% as the cost-of-living crisis weighs on the economy. According to a Bloomberg survey, tThe probability of a recession is now estimated at 75%, a sharp increase from 44% at the beginning of July and higher than at any time since September 2020, when the pandemic was taking its toll..

The half-point increase announced on August 4 is expected to be followed by a similar increase in September with one subsequent rise of a quarter of a point in NovemberWhich one will take the BoE benchmark at 2.5%, above the previously forecast maximum of 2%. Money markets are priced above 3% in February.

Market reaction

GBPUSD Daily Chart

Source: TradingViewprepared by Zain Vawda

The initial reaction was relatively subdued with GBPUSD up 30 pips before pulling back and trading lower. From approaching the key psychological level 1.20 (aligned with 61.8% fib level) yesterday we saw a rise of about 120 pips before the CPI print leaked. We are hovering between 1200 and 1225 since July 25th with a breakup anytime soon doesn’t seem likely. Price action is indecisive, as is the lack of structure (either bullish or bearish) as sentiment changes continuously.

Key intraday levels worth watching:

Support areas

1.2050 (0.50% fiber level)1.2000 (key psychological level)

Zones of resistance

1.2180 (23.6 fib level)1.2250 (key psychological level)

— Written by Zain Vawda for DailyFX.com

Contact and follow Zain on Twitter: @is over

element within element. Surely this is not what you wanted to do! Instead, you load your application’s JavaScript package inside the element.

[ad_2]

Source link