Analysis of the producer price index (inflation).

May’s month-on-month PPI is below consensus estimates. The lower PPI adds to lower CPI impressions earlier this week and raises the possibility of a ‘no hike’ scenario this afternoon EUR/USD and GBP/USD trading higher, as both central banks have indicated no increase. pause in their respective ramp-up cyclesThe analysis in this article makes use of graphics patterns and key support and resistance levels For more information visit our complete education library

Recommended by Richard Snow

Introduction to Forex News Trading

May’s monthly PPI fell to -0.3% after consensus had initially expected a 0.1% drop. The year-on-year PPI fell significantly, from 2.3% to 1.1%, while the core measure fell from 3.2% to 2.8%, also beating estimates of 2.9%.

Customize and filter live economic data using our DailyFX economic calendar

Lower inflation appears to have arrived just in time for the Fed, which appears to be favoring a no-hike scenario ahead of the FOMC statement due at 7pm today. The committee has previously noted that they will take into account past rate hikes, lag effects and other developments to determine whether additional tightening will be appropriate. Additionally, Fed Chairman Jerome Powell indicated last month that the current rate level is within “tightening” territory, a further indication that the Fed believes it has earned the right to slow the cycle rate rise.

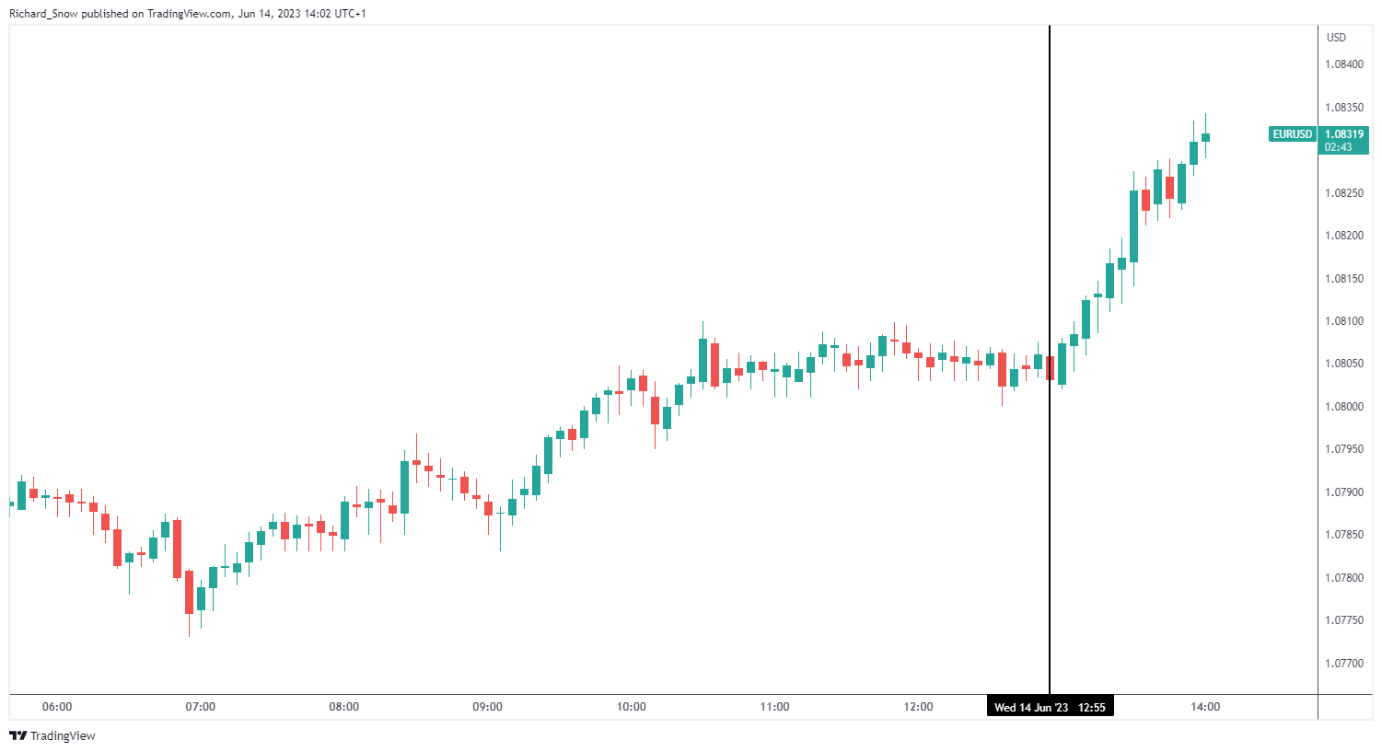

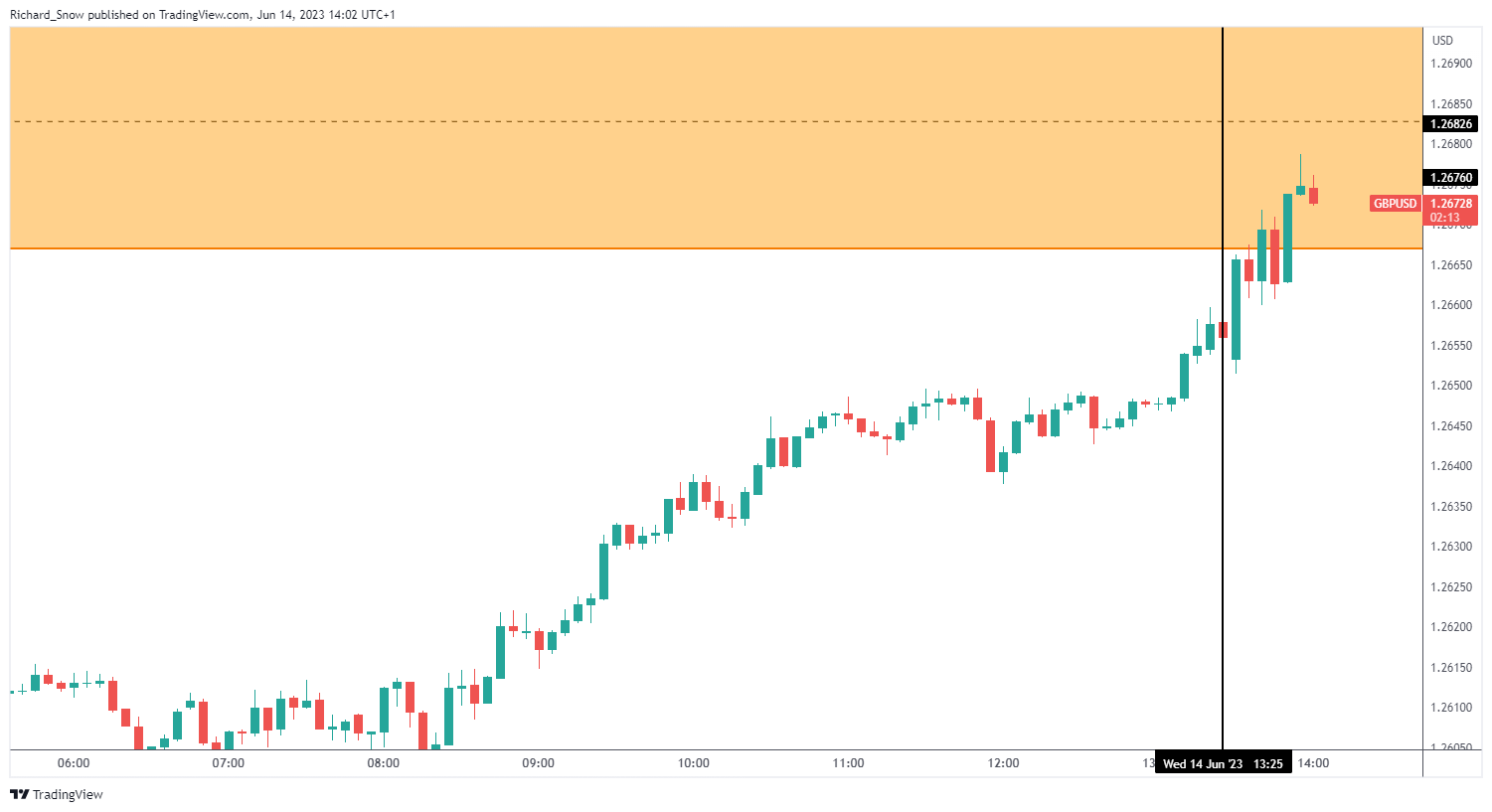

Markets continued to move in the direction of recent momentum, with EUR/USD and GBP/USD higher as both the ECB and BoE will continue to raise interest rates at some point in which the Fed could effectively be on pause.

EUR/USD has been clawing back losses experienced throughout the month of May and the move has continued with increased added intensity after factory gate prices eased. Lower inflation lends itself to a tighter terminal rate in the US, while the ECB continues to call for hikes with core inflation still elevated.

Chart EUR/USD 5- Min

Source: TradingView, powered by Richard Snow

Likewise, the cable has shown a similar path, but has fared much better than the euro, as the falls have not been as severe. In late May, the cable rallied and today’s inflation data has lifted the pair into the resistance zone around 1.2700, an immediate test for the bullish resolution.

GBP/USD 5 minute chart

Source: TradingView, powered by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

element within element. Surely this is not what you wanted to do! Instead, you load your application’s JavaScript package inside the element.

[ad_2]

Source link